UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to

Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant | ||

| Filed by a Party other than the Registrant | ||

| Check the appropriate box: | ||

| Preliminary Proxy Statement | ||

| Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||

| Definitive Proxy Statement | ||

| Definitive Additional Materials | ||

| Soliciting Material Pursuant to §240.14a-12 | ||

ANIKA THERAPEUTICS, INC.

(Name of Registrant as Specified in Its Charter)

| Payment of Filing Fee (Check the appropriate box): | ||

| No fee required. | ||

| Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| ☐ | Fee paid previously with preliminary materials. | |

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

Anika Therapeutics, Inc.

32 Wiggins Avenue

Bedford, Massachusetts 01730

Notice of

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

The 2018 Annual Meeting of Stockholders to be Held on June 13, 2017

The 2017 Annual Meeting of Stockholders (including any adjournments or postponements, the “Annual Meeting”) of Anika Therapeutics, Inc., a Massachusetts corporation (the "Company"(“Anika"), will be held at the Company’sAnika’s corporate headquarters, 32 Wiggins Avenue, Bedford, Massachusetts 01730, on Tuesday, June 13, 2017,Thursday, May 31, 2018, at 11:30 a.m., local time to consider and vote upontime.

At the Annual Meeting the following matters:matters will be considered:

| 1. | |

| 2. | |

| in Delaware; | |

| 3. | |

| 4. | ratification of the appointment of Deloitte & Touche LLP as |

| year ending December 31, 2018; | |

| 5. | |

| 6. |

Only stockholders of record of common stock par value $0.01 per share, at the close of business on April 17, 2017,2, 2018, the record date, will be entitled to receive notice of and to vote at the Annual Meeting.

AllProxies are being solicited on behalf of the Board of Directors. We have adopted the Securities and Exchange Commission rule that allows companies to furnish proxy materials over the Internet. We are mailing a Notice of Internet Availability of Proxy Materials (the “Internet Availability Notice”) to most of our stockholders are cordially invitedinstead of a paper copy of this Proxy Statement and our 2017 Annual Report. The Internet Availability Notice contains instructions on how to access and review those documents over the Internet. This process allows us to provide stockholders with the information they need in a more timely manner, while reducing the environmental impact and lowering the costs of printing and distributing our proxy materials. If you received an Internet Availability Notice by mail and would like to receive a printed copy of our proxy materials, you may request those materials by following the instructions included in the Internet Availability Notice.

Your vote is very important. Whether or not you plan to attend the Annual Meeting, in person. To assureplease complete and return your representation at the Annual Meeting, the Board of Directors urges you toproxy card or vote by telephone or via the Internet atwww.proxyvote.com by following the instructions on the Notice Regarding theInternet Availability of Proxy Materials you receive in the mail or, if you have requestedNotice. Returning a proxy card by mail, by signing, voting, and returningor otherwise submitting your proxy card in the enclosed envelope. You may also vote via telephone by visitingwww.proxyvote.com and following the instructions on the website or, ifdoes not deprive you have requested the proxy materials by mail, by following the instructions on the proxy card. For specific instructions on howof your right to vote your shares, please review the instructions for each of these voting options that are detailed in this Notice and in the accompanying proxy statement, which the Company expects to begin mailing or otherwise providing to its stockholders on or about April 28, 2017. If you attend the Annual Meeting you mayand vote in person even if you have previously returned your proxy card or have voted via the Internet or by telephone. Regardless of the number of shares you own, your vote is important.

In addition to their availability atwww.proxyvote.com, the proxy statement and a form of proxy card, together with the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2016, are available for viewing, printing, and downloading athttp://www.anikatherapeutics.com/proxy.

person.

| By Order of the Board of Directors, | |

| |

| Sylvia Cheung | |

| Chief Financial Officer & Secretary | |

| Bedford, Massachusetts | |

| April [•], 2018 |

|  Bedford, Massachusetts 01730 |

Proxy Statement dated April [•], 2018

2018 Annual Meeting of Stockholders

Anika Therapeutics, Inc., a Massachusetts corporation, is furnishing this Proxy Statement and related proxy materials in connection with the solicitation by its Board of Directors of proxies to be voted at its 2018 Annual Meeting of Stockholders and any adjournments. Anika Therapeutics, Inc. is providing these materials to the holders of record of its common stock as of the close of business on April 2, 2018 and is first making available or mailing the materials on or about April [•], 2018.

The Annual Meeting is scheduled to be held as follows:

| Date | Thursday, May 31, 2018 | |

| Time: | ||

| Meeting Address: | 32 Wiggins Avenue, Bedford, Massachusetts | |

| 01730 |

WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING IN PERSON, YOU ARE REQUESTED TO COMPLETE YOUR PROXY CARD AS INDICATED ABOVE. YOUR PROXY IS REVOCABLE UP TO THE TIME SET FORTH IN THE PROXY STATEMENT, AND, IF YOU ATTEND THE ANNUAL MEETING, YOU MAY VOTE IN PERSON EVEN IF YOU HAVE PREVIOUSLY COMPLETED YOUR PROXY CARD.

2017 Proxy

Table of Contents

Your vote is important. Please see the detailed information that follows.

| i |

Table of Contents

| 1 | ||

| PROPOSAL 1: ELECTION OF DIRECTORS | 8 | |

| Vote Required | 8 | |

| Board Recommendation | 8 | |

| Information Regarding the Directors | ||

| The Board’s Role in Risk Oversight | ||

| Board Leadership Structure | 11 | |

| Corporate Governance, Board Matters and Committees | 11 | |

| Communications with the Board | ||

| Code of Business Conduct | 14 | |

| Majority Voting in Uncontested Director Elections Policy | 14 | |

| Transactions with Related Persons and Conflict of Interest Policy | 14 | |

| Section 16(a) Beneficial Ownership Reporting Compliance | 16 | |

| EXECUTIVE OFFICERS | 17 | |

| COMPENSATION DISCUSSION AND ANALYSIS | 18 | |

| Executive | 18 | |

| Compensation | 19 | |

| 20 | ||

| 22 | ||

| 24 | ||

| EXECUTIVE COMPENSATION | 27 | |

| Summary Compensation Table | ||

| Option Grants and Plan Awards in | ||

| Outstanding Equity Awards at December 31, | ||

| Potential Payments Upon Termination or Change in Control | ||

| CEO Pay Ratio | ||

| Director Compensation | ||

| Compensation Committee Interlocks and Insider Participation | ||

| 33 | ||

| PROPOSAL 2: | 34 | |

| Principal Features of the | ||

| 42 | ||

| 43 | ||

| 44 | ||

| AUDIT COMMITTEE REPORT | 46 | |

| PROPOSAL 4: RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITOR FOR 2018 | 47 | |

| PROPOSAL 5: ADVISORY VOTE ON EXECUTIVE COMPENSATION | 50 | |

| OTHER MATTERS | 51 | |

| SOLICITATION EXPENSES | 51 | |

| STOCKHOLDER PROPOSALS | 51 | |

| APPENDIX A | 52 | |

| APPENDIX B | 54 | |

| APPENDIX C | 58 | |

References in this proxy statementProxy Statement to “we,” “us,” “our,” “our company,”company” and other similar references refer to Anika Therapeutics, Inc. and its subsidiaries, unless the context requires otherwise.

ANIKA, ANIKA THERAPEUTICS, CINGAL, ORTHOVISC, and MONOVISCCINGAL are our registered trademarks. This proxy statementProxy Statement also contains a registered trademarktrademarks that isare the property of another company and is licensed exclusively to us.other companies.

2018 Proxy Summary

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting.

Annual Meeting of Stockholders

| Time and Date | 11:30 a.m. | |||||

| Place | 32 Wiggins Avenue, Bedford, Massachusetts | |||||

| Record Date | April 2, 2018 | |||||

| Voting | Stockholders will be entitled to one vote at the Annual Meeting for each outstanding share of common stock they hold of record as of the record date. | |||||

| Outstanding Common Stock | 14,745,152 shares as of the record date | |||||

Annual Meeting Agenda

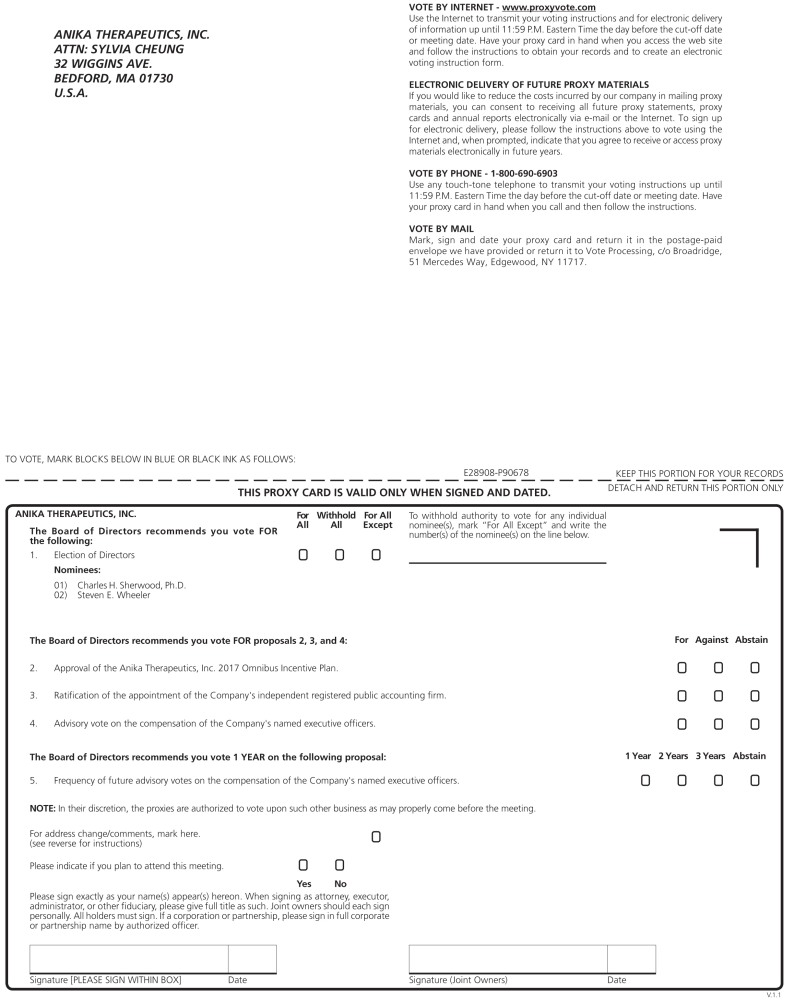

| Proposal | Board Recommendation | |||

| 1 | Election of directors | FOR each nominee | ||

| 2 | Reincorporation in Delaware | FOR | ||

| 3 | Authorized share increase | FOR | ||

| 4 | Ratification of independent auditors for 2018 | FOR | ||

| 5 | Advisory “say on pay” vote | FOR | ||

How to Cast Your Vote

You can vote by any of the following methods:

| Until 11:59 p.m., EDST, on May 30, 2018 | At the Annual Meeting on May 31, 2018 | |||||||

| • | • | In person: | ||||||

| • | Telephone: +1-800-690-6903 if you are the stockholder of record or beneficially hold shares in “street name” | 4 | If you are the stockholder of record, your admission ticket is attached to your proxy card | |||||

| • | Completed, signed, and returnedproxy card | 4 | If you beneficially own shares held in “street name,” you must bring proof of ownership | |||||

| 1 |

| Proposal 1: Election of Directors | ||||||

| Director Nominee | Age | Director Since | Occupation | Experience / Qualifications | Independent | Committee Memberships | Other Boards | |||

| Joseph L. Bower, D.B.A. | 79 | 1993 | Donald Kirk Davis Professor Emeritus at Harvard Business School | • Leadership • General Experience

| Yes | • Compensation (Chair) • Audit | • Loews Corporation • New America High Income Fund | |||

| Jeffery S. Thompson | 52 | 2011 | Partner, Healthedge Investment Partner, LLC | • Leadership • Industry Experience

| Yes | • Compensation • Audit

| • Sinclair Pharma, plc • MNG Laboratories, LLC • Westone Laboratories • Lifesync Corp. • The Columbus Organization, LLC • Data Dimensions, LLC

|

| Proposal 1: Election of Directors | |||||||||

| Director Nominee | Age | Director Since | Occupation | Experience / Qualifications | Independent | Committee Memberships | Other Boards | ||

| Charles H. Sherwood, Ph.D. | 70 | 2002 | President and Chief Executive Officer of Anika Therapeutics, Inc. | ● Leadership ● Company & Industry Experience | No | None | None | ||

| Steven E. Wheeler | 70 | 1993 | President of Wheeler & Co. | ● Leadership ● General Experience | Yes | ● Governance and Nominating (Chair) ● Compensation | ● HFF, Inc. | ||

| Board Recommendation: | The Board recommends a vote “FOR” the reelection of Dr. Sherwood and Mr. Wheeler. | ||||||||

| Vote Required for Approval: | Affirmative vote of a majority of votes cast by holders of common stock. Abstentions and broker non-votes will not be treated as votes cast and will have no impact on the proposal, except to the extent that failure to vote for an individual results in another individual receiving a larger percentage of votes. | ||||||||

| 2 | |||||||||

| Board | The Board of Directors recommends a vote “FOR” | ||||

| Dr. Bower and Mr. Thompson. | |||||

| Vote Required for Approval: | Affirmative vote of a majority of | ||||

| votes cast. Abstentions and broker non-votes | |||||

| Proposal 2: Approval of Delaware Reincorporation | |||||

| The Board of Directors has approved a proposal to change our state of incorporation from the Commonwealth of Massachusetts to the State of Delaware. | |||||

| Board Recommendation: | The Board recommends a vote “FOR” our reincorporation in Delaware. | ||||

| Vote Required for Approval: | |||||

| Affirmative vote of two-thirds of the issued and outstanding shares of common stock. Abstentions and broker non-votes, if any, will be counted as votes against the reincorporation in Delaware. | |||

| Proposal 3: Authorized Share Increase | |||

| The Board of Directors has approved a proposal to increase the aggregate number of shares of common stock that we are authorized to issue from 60,000,000 to 90,000,000. If approved, this increase will be implemented whether or not Proposal 2 is approved. | |||

| Board Recommendation: | The Board recommends a vote “FOR” the increase in authorized shares. | ||

| Vote Required for Approval: | Affirmative vote of a majority of the issued and outstanding shares of common stock. Abstentions and broker non-votes, if any, will be counted as votes against the increase in authorized shares. | ||

| Proposal 4: Ratification of Auditors for | |||

| The Audit Committee has approved the retention of Deloitte & Touche LLP as our independent registered public accounting firm with respect to | |||

| 2018. | |||

| Board Recommendation: | The Board of Directors recommends a vote “FOR” the ratification of Deloitte & Touche LLP as our independent | ||

| 2018. | |||

| Vote Required for Approval: | Affirmative vote | ||

| 2 |

| Proposal | |||||||

| The overall objective of our executive compensation policy is to attract and retain highly qualified executive officers and to motivate those officers to provide superior performance for the benefit of our company and stockholders. | |||||||

| Compensation Element | Description | Objectives | |||||

| Base Salary | • | Fixed cash compensation | • | ||||

| Cash Bonuses | • | Annual cash award based on performance of company and individual | • | Reward the achievement of financial results, organizational development, business and technical development, individual goals, and contribution to | |||

| • | Prorated in the year of hire if employment begins before October 1 | • | Encourage retention | ||||

| • | Grants of stock options, or other forms of equity securities, under | • | Provide executive officers with opportunity to be compensated based on common stock price | ||||

| • | Includes stock appreciation rights, restricted stock awards and performance-based equity awards | • | Align interests of our executive officers with those of our stockholders | ||||

| Summary Compensation Table | ||||||||||||||||||||||||||||||

| Name and Principal Position | Year | Salary | Bonus | Option Awards | Stock Awards | All Other Compensation | Total | |||||||||||||||||||||||

| Charles H. Sherwood, Ph.D. | 2016 | $ | 601,586 | $ | 496,308 | $ | 1,519,778 | $ | 861,286 | $ | 52,060 | $ | 3,531,018 | |||||||||||||||||

| President and Chief | 2015 | $ | 581,242 | $ | 508,587 | $ | 864,043 | $ | 535,815 | $ | 52,118 | $ | 2,541,805 | |||||||||||||||||

| Executive Officer | 2014 | $ | 564,313 | $ | 434,521 | $ | 694,130 | $ | 496,310 | $ | 41,093 | $ | 2,230,367 | |||||||||||||||||

| Ed Ahn, Ph.D. | 2016 | $ | 315,675 | $ | 156,259 | $ | 439,830 | $ | 301,069 | $ | 18,720 | $ | 1,231,553 | |||||||||||||||||

| Chief Technology and | 2015 | $ | 305,000 | $ | 137,250 | $ | 43,953 | $ | - | $ | 18,720 | $ | 504,923 | |||||||||||||||||

| Strategy Officer | 2014 | $ | 43,404 | $ | - | $ | 733,170 | $ | - | $ | 2,164 | $ | 778,738 | |||||||||||||||||

| Dana Alexander | 2016 | $ | 285,000 | $ | 76,950 | $ | 759,247 | $ | - | $ | 13,187 | $ | 1,134,384 | |||||||||||||||||

| Chief Operations Officer | ||||||||||||||||||||||||||||||

| Sylvia Cheung | 2016 | $ | 346,942 | $ | 171,736 | $ | 439,830 | $ | 301,069 | $ | 18,720 | $ | 1,278,297 | |||||||||||||||||

| Chief Financial Officer | 2015 | $ | 335,210 | $ | 188,556 | $ | 289,996 | $ | 264,931 | $ | 18,720 | $ | 1,097,413 | |||||||||||||||||

| 2014 | $ | 307,000 | $ | 151,965 | $ | 247,519 | $ | 195,322 | $ | 13,719 | $ | 915,525 | ||||||||||||||||||

| Richard Hague | 2016 | $ | 315,000 | $ | 127,575 | $ | 439,830 | $ | 301,069 | $ | 84,799 | $ | 1,268,273 | |||||||||||||||||

| Chief Commerical Officer | 2015 | $ | 48,462 | $ | - | $ | - | $ | 727,650 | $ | 24,831 | $ | 800,943 | |||||||||||||||||

| Stephen Mascioli, M.D., MPH | 2016 | $ | 350,000 | $ | - | $ | 759,247 | $ | - | $ | 27,473 | $ | 1,136,720 | |||||||||||||||||

| Chief Medical Officer | ||||||||||||||||||||||||||||||

| Summary Compensation Table | ||||||||||||||||||||||||||||

| Name and Principal Position | Year | Salary | Bonus | Option Awards | Stock Awards | All Other Compensation | Total | |||||||||||||||||||||

| Charles H. Sherwood, Ph.D. | 2017 | $ | 622,641 | $ | 466,981 | $ | 2,960,954 | $ | - | $ | 187,037 | $ | 4,237,612 | |||||||||||||||

| Chief Executive Officer | 2016 | $ | 601,586 | $ | 496,308 | $ | 1,519,778 | $ | 861,286 | $ | 52,060 | $ | 3,531,018 | |||||||||||||||

| 2015 | $ | 581,242 | $ | 508,587 | $ | 864,043 | $ | 535,815 | $ | 52,118 | $ | 2,541,805 | ||||||||||||||||

| Sylvia Cheung | 2017 | $ | 359,085 | $ | 185,827 | $ | 709,054 | $ | - | $ | 18,720 | $ | 1,272,686 | |||||||||||||||

| Chief Financial Officer | 2016 | $ | 346,942 | $ | 171,736 | $ | 439,830 | $ | 301,069 | $ | 18,720 | $ | 1,278,297 | |||||||||||||||

| 2015 | $ | 335,210 | $ | 188,556 | $ | 289,996 | $ | 264,931 | $ | 18,720 | $ | 1,097,413 | ||||||||||||||||

| Joseph G. Darling | 2017 | $ | 181,987 | $ | 93,990 | $ | 750,281 | $ | 749,960 | $ | 5,993 | $ | 1,782,212 | |||||||||||||||

| President | ||||||||||||||||||||||||||||

| Ed Ahn, Ph.D. | 2017 | $ | 347,243 | $ | 125,007 | $ | 599,331 | $ | - | $ | 19,080 | $ | 1,090,662 | |||||||||||||||

| Chief Technology and | 2016 | $ | 315,675 | $ | 156,259 | $ | 439,830 | $ | 301,069 | $ | 18,720 | $ | 1,231,553 | |||||||||||||||

| Strategy Officer | 2015 | $ | 305,000 | $ | 137,250 | $ | 43,953 | $ | - | $ | 18,720 | $ | 504,923 | |||||||||||||||

| Richard Hague | 2017 | $ | 326,025 | $ | 102,698 | $ | 599,331 | $ | - | $ | 27,096 | $ | 1,055,150 | |||||||||||||||

| Chief Commerical Officer | 2016 | $ | 315,000 | $ | 127,575 | $ | 439,830 | $ | 301,069 | $ | 84,799 | $ | 1,268,273 | |||||||||||||||

| 2015 | $ | 48,462 | $ | - | $ | - | $ | 727,650 | $ | 24,831 | $ | 800,943 | ||||||||||||||||

| Board Recommendation: | The Board of Directors recommends a vote “FOR” the approval of executive compensation for the | ||

| Vote Required for Approval: | Affirmative vote | ||

Anika Therapeutics, Inc.

32 Wiggins Avenue

Bedford, Massachusetts 01730

Proxy Statement for

2017 Annual Meeting of Stockholders

To be Held on Tuesday, June 13, 2017

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors of Anika Therapeutics, Inc., a Massachusetts corporation, for use at the 2017 Annual Meeting of Stockholders (the “Annual Meeting”) to be held at our corporate headquarters, 32 Wiggins Avenue, Bedford, Massachusetts 01730, on Tuesday, June 13, 2017, at 11:30 a.m. local time. At the Annual Meeting, the stockholders will be asked to consider and vote upon the following matters:

Proposal 1 relates solely to the election of two Class III directors nominated by the Board of Directors and does not include any other matter relating to the election of directors, including without limitation, the election of directors nominated by any stockholder.

This proxy statement, the accompanying notice of the Annual Meeting, the form of proxy, and our Annual Report are first being made available to stockholders on or about April 28, 2017. Our Annual Report, however, is not a part of the proxy solicitation materials. The Board of Directors has fixed the close of business on April 17, 2017 as the record date for the determination of stockholders entitled to receive notice of and to vote at the Annual Meeting. Only stockholders of record of our common stock, par value $0.01 per share, at the close of business on the record date will be entitled to receive notice of and to vote at the Annual Meeting. As of the record date, there were 14,654,590 shares of common stock outstanding and entitled to vote at the Annual Meeting. Holders of common stock as of the close of business on the record date will be entitled to one vote per share.

This year, pursuant to rules adopted by the Securities and Exchange Commission (the “SEC”), we have again elected to provide access to our proxy materials over the Internet. Accordingly, we have sent a Notice Regarding the Availability of Proxy Materials (the “Notice”) to certain of our stockholders (excluding those stockholders who previously have requested that they receive electronic or paper copies of our proxy materials). Stockholders have the ability to access our proxy materials on the website referred to in the Notice or to request a printed set of our proxy materials at no charge. Instructions on how to access our proxy materials over the Internet and how to request a printed copy of our proxy materials may be found in the Notice. In addition, stockholders may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis. We believe this process will expedite your receipt of our proxy materials and reduce the environmental impact of our Annual Meeting.

You may vote via the Internet atwww.proxyvote.com by following the instructions in the Notice you received in the mail and which are also provided on that website, or, if you have requested a proxy card by mail, by signing, voting, and returning your proxy card. You may also vote via telephone by visitingwww.proxyvote.com and following the instructions on the website, or, if you have requested the proxy materials by mail, by following the instructions on the proxy card. If you attend the Annual Meeting, you may vote in person even if you have previously voted by telephone, via the Internet, or returned a proxy card by mail. If you hold your shares in street name, you will receive instructions from your broker, bank, or other nominee that you must follow in order to have your shares voted.

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before it is voted. Proxies may be revoked by: (a) filing with our Secretary, before the taking of the vote at the Annual Meeting, a written notice of revocation bearing a later date than the proxy; (b) properly casting a new vote via the Internet or by telephone at any time before the closure of the Internet or telephone voting facilities; (c) duly completing a later-dated proxy relating to the same shares and delivering it to our Secretary before the taking of the vote at the Annual Meeting; or (d) attending the Annual Meeting and voting in person (although attendance at the Annual Meeting will not in and of itself constitute a revocation of a proxy). Any written notice of revocation or subsequent proxy should be sent so as to be delivered to Anika Therapeutics, Inc., 32 Wiggins Avenue, Bedford, Massachusetts 01730, Attention: Secretary, before the taking of the vote at the Annual Meeting.

All properlyQuestions and Answers about the Annual Meeting

| Q: | When and where will the Annual Meeting be held? |

| A: | This year the Annual Meeting of Stockholders of Anika Therapeutics, Inc., which we refer to below as the Annual Meeting, will be held at our corporate headquarters, 32 Wiggins Avenue, Bedford, Massachusetts 01730, on Thursday, May 31, 2018, at 11:30 a.m., local time. |

| Q: | What materials have been prepared for stockholders in connection with the Annual Meeting? |

| A: | We are furnishing stockholders of record with access to, or copies of, the following proxy materials: |

These materials were first made available on the Internet or mailed to stockholders on or about April [•], 2018.

| Q: | Why was I mailed a Notice of Internet Availability of Proxy Materials rather than a printed set of proxy materials? |

| A: | In accordance with rules and regulations adopted by the Securities and Exchange Commission or SEC, we are furnishing the proxy materials to most stockholders by providing access via the Internet, instead of mailing printed copies. This e-proxy process expedites our stockholders’ receipt of proxy materials, lowers our costs, and reduces the environmental impact of the Annual Meeting. |

The Notice of Internet Availability of Proxy Materials tells you how to access and review the proxy materials on the Internet and how to vote on the Internet. The Notice also provides instructions you may follow to request paper or e-mailed copies of our proxy materials.

| Q: | Are the proxy materials available via the Internet? |

| A: | You can access the proxy materials for the Annual Meeting at ir.anikatherapeutics.com/financial-information/annual-reports. |

| Q: | What is a proxy? |

| A: | Because it is important that as many stockholders as possible be represented at the Annual Meeting, the Board of Directors asks that you review this Proxy Statement carefully and then vote by following the instructions set forth on the Notice of Internet Availability of Proxy Materials or proxy card. In voting prior to the Annual Meeting, you will deliver your proxy to Joseph Darling and Sylvia Cheung, which means you will authorize Mr. Darling and Ms. Cheung to vote your shares at the Annual Meeting in the way you instruct. All shares represented by valid proxies will be voted in accordance with the stockholder’s specific instructions. |

| Q: | What matters will the stockholders vote on at the Annual Meeting? |

| A: | • | Proposal 1. Election of two director nominees: Joseph Bower and Jeffery Thompson. |

| 4 |

| Q: | Why are we proposing to reincorporate in Delaware? |

| A: | We believe that reincorporating in Delaware will give us a greater measure of flexibility and certainty in corporate governance than is available under Massachusetts law. Delaware is recognized for adopting comprehensive, modern, and flexible corporate laws, which are revised periodically to respond to the changing legal and business needs of corporations. Delaware’s specialized business judiciary is composed of experts in corporate law matters, and a substantial body of court decisions has developed construing Delaware corporation law. As a result, Delaware law provides greater clarity and predictability with respect to our corporate legal affairs than is currently the case under Massachusetts law. For these and other reasons, many major U.S. corporations have incorporated in Delaware or have changed their corporate domiciles to Delaware in a manner similar to the manner outlined in Proposal 2. |

| Q: | What is entailed by the reincorporation? |

| A: | We are currently incorporated in Massachusetts and, as such, governed by Massachusetts law. As a result of the reincorporation, we will be reincorporated in Delaware and governed by Delaware law. The reincorporation will be effected by a plan of domestication that has been adopted by the Board of Directors. A copy of this plan of domestication is attached asAppendix A. |

The reincorporation will not revoked priorinvolve any change in our business, directors, officers, management, properties, or corporate headquarters.

| Q: | How will the reincorporation affect my rights as a stockholder? |

| A: | Your rights as a stockholder currently are governed by Massachusetts law, our Restated Articles of Organization, as amended, and our Amended and Restated By-Laws. As a result of the reincorporation, you will remain a stockholder of our company with rights governed by Delaware law and our new Certificate of Incorporation and Bylaws, which differ in various respects from your current rights. These important differences are discussed in this Proxy Statement under “Proposal 2: Delaware Reincorporation─Comparison of Stockholder Rights Before and After the Reincorporation.” Forms of our new Certificate of Incorporation and Bylaws after the reincorporation are attached to this Proxy Statement asAppendixesB and C, respectively. |

| Q: | How will the reincorporation affect my ownership percentage in our company? |

| A: | Your proportionate ownership interest in our company will not be affected by the reincorporation. |

| Q: | Are dissenters’ rights available in connection with the reincorporation? |

| A: | No. Massachusetts law does not afford stockholders dissenters’ rights in connection with a reincorporation. |

| Q: | Why are we proposing to increase the number of authorized shares of our common stock to 90,000,000? |

| A: | We believe that an increase in our number of authorized shares of common stock would place us in a more equal position relative to our peers and competitors. We also believe that an approval of this proposal is desirable to provide us greater flexibility to manage our business and support our growth plans. While we have no current specific plans for the additional shares, future growth-supporting initiatives utilizing such shares may include raising additional capital through stock offerings, issuing share dividends, providing equity incentives to attract or retain executives, employees, and directors, or funding potential M&A opportunities using common stock as consideration. |

| Q: | Who can vote at the Annual Meeting? |

| A: | Stockholders of record of common stock at the close of business on April 2, 2018, the record date, will be entitled to vote at the Annual Meeting. A total of 14,745,152 shares of common stock were outstanding as of the record date. Each share outstanding on the record date will be entitled to one vote on each proposal. |

| Q: | What is a stockholder of record? |

| A: | A stockholder of record is a stockholder whose ownership of our common stock is reflected directly on the books and records of our transfer agent, American Stock Transfer & Trust Co. |

| 5 |

| Q: | What does it mean for a broker or other nominee to hold shares in “street name”? |

| A: | If you beneficially own shares held in an account with a broker, bank, or similar organization, that organization is the stockholder of record and is considered to hold those shares in “street name.” |

An organization that holds your beneficially owned shares in street name will vote in accordance with the instructions you provide. If you do not provide the organization with specific voting instructions with respect to a proposal, under the rules of the NASDAQ Stock Market, Inc., or NASDAQ, the organization’s authority to vote your shares will depend upon whether the proposal is considered a “routine” or non-routine matter.

The presence, in person or by proxy,For the purpose of holders of at least a majority of the total number of outstanding shares of common stock entitled to vote is necessary to constitutedetermining a quorum, for the transaction of business at the Annual Meeting. Shares held of record by stockholders or their nominees who do not return a signed and dated proxy or attend the Annual Meeting in personwe will not be consideredtreat as present or represented at the Annual Meeting and will notany proxies that are voted on any of the four proposals to be countedacted upon by the stockholders, including abstentions or proxies containing broker non-votes.

| Q: | How do I vote my shares if I do not attend the Annual Meeting? |

| A: | If you are a stockholder of record, you may vote prior to the Annual Meeting as follows: |

| • | Via the Internet: You may vote via the Internet atwww.proxyvote.com, in accordance with the voting instructions printed on the Notice of Internet Availability of Proxy Materials and the proxy card. Internet voting is available 24 hours a day until 11:59 p.m., Eastern daylight saving time, on May 30, 2018. You will be given the opportunity to confirm that your instructions have been recorded properly. If you vote via the Internet, you do not need to return a proxy card. |

| • | By Telephone: If you receive a proxy card by mail, you may vote by calling 1-800-690-6903 and following the instructions provided on the telephone line. Telephone voting is available 24 hours a day until 11:59 p.m., Eastern daylight saving time, on May 30, 2018. Easy-to-follow voice prompts allow you to vote your shares and confirm that your instructions have been recorded properly. If you vote by telephone, you do not need to return a proxy card. |

| • | By Mail: If you receive a proxy card by mail, you may vote by returning the completed and signed proxy card in the postage-paid return envelope provided with the proxy card. |

If you hold shares in determiningstreet name, you may vote by following the presence of a quorum. Proxies withholding authorityvoting instructions provided by your bank, broker, or marked as abstaining from a particular matter will be treated as present for purposes of determining whether a quorum is present forother nominee. In general, you may vote prior to the Annual Meeting but will not be counted as follows:

| • | Via the Internet: You may vote atwww.proxyvote.com, in accordance with the voting instructions printed on the Notice of Internet Availability of Proxy Materials and the proxy card. Internet voting is available 24 hours a day until 11:59 p.m., Eastern daylight saving time, on May 30, 2018. You will be given the opportunity to confirm that your instructions have been recorded properly. |

| • | By Telephone: If you receive a proxy card by mail, you may vote by calling 1-800-690-6903 and following the instructions provided on the telephone line. Telephone voting is available 24 hours a day until 11:59 p.m., Eastern daylight saving time, on May 30, 2018. Easy-to-follow voice prompts allow you to vote your shares and confirm that your instructions have been recorded properly. |

| • | By Mail: You may vote by returning a completed and signed proxy card in accordance with instructions provided by your bank, broker, or other nominee. |

For your information, voting on any proposal for which authorityvia the Internet is withheldthe least expensive to us, followed by telephone voting, with voting by mail being the most expensive. Also, you may help us to save the expense of a second mailing if you vote promptly.

| Q: | Can I vote at the Annual Meeting? |

| A: | If you are a stockholder of record, you may vote in person at the Annual Meeting, whether or not you previously voted. If your shares are held in street name, you must obtain a written proxy, executed in your favor, from the stockholder of record to be able to vote at the Annual Meeting. |

| 6 |

| Q: | May I change my vote or revoke my proxy? |

| A: | If you are a stockholder of record, you may later change or revoke your proxy at any time before it is exercised by: |

If you are a beneficial owner of shares held in street name, you should contact your common stock is held by abank, broker, bank, or other nominee (i.e., in “street name”) and you fail to givefor instructions as to whether, and how, you wantcan change or revoke your proxy.

| Q: | What happens if I do not give specific voting instructions? |

| A: | If you are a stockholder of record and you return a proxy card without giving specific voting instructions, the proxy holders will vote your shares in the manner recommended by the Board of Directors on all five proposals presented in this Proxy Statement and as they may determine in its discretion on any other matters properly presented for a vote at the Annual Meeting. |

If you are a beneficial owner of shares voted,held in street name and do not provide specific voting instructions to the broker, bank, or other nomineeorganization that is the stockholder of record of your shares, the organization generally may vote your shares on routine matters but not on non-routine matters. The only routine matter expected to be voted on at the Annual Meeting is the ratification of the appointment of our independent auditor for 2018 (Proposal 4). If the organization does not receive instructions from you on how to vote your shares on a non-routine matter, it will inform the inspectorone or more of the election that it does not have the authority to vote on this matter with respect toProposals 1, 2, 3 and 5, your shares. This is referred to as a “broker non-vote.” The only routine matter expected to be voted on at the 2017 Annual Meeting is the ratification of our independent auditor for 2017. Each other proposal is considered non-routine, and broker non-votes will have no impact on the approval of the proposal. Instead, broker non-votesshares will be counted onlysubject to a broker non-vote and no vote will be cast on those matters. See “Q. What does it mean for the purpose of determining the presencea broker or absence of a quorum for the transaction of business.other nominee to hold shares in ‘street name’?” above.

| Q: | What if other matters are presented at the Annual Meeting? |

| A: | If a stockholder of record provides a proxy by voting in any manner described in this Proxy Statement, the proxy holders will have the discretion to vote on any matters, other than the five proposals presented in this Proxy Statement, that are properly presented for consideration at the Annual Meeting. We do not know of any other matters to be presented for consideration at the Annual Meeting. |

At the Annual Meeting, Proposal 1 requires, with respect to each director, the affirmative vote of a majority of votes cast at the Annual Meeting by the holders of common stock pursuant to our Majority Voting in Uncontested Director Elections Policy. In accordance with this policy, if a director in an uncontested election does not receive at least the majority of the votes cast (including votes “for” and votes “withheld”), such director is required to promptly tender his resignation from the Board of Directors. The Majority Voting in Uncontested Director Elections Policy is described below in the section captioned “Majority Voting in Uncontested Director Elections Policy” on page 14. For each of Proposals 2 through 5, the affirmative vote of the holders of a majority of shares of common stock present or represented at the Annual Meeting and voting on the matter is required. With respect to Proposal 5, however, if none of the frequency options receives the affirmative vote of the holders of a majority of the shares present or represented and voting, the option receiving the greatest number of votes will be considered the frequency recommended by the stockholders. With respect to each of Proposals 2 through 4, stockholders may vote “for,” “against,” or “abstain.” With respect to Proposal 5, stockholders may either vote to recommend an advisory vote every one, two, or three years or abstain from voting.

Important Notice Regarding the Availability of Proxy Materials for the 2017 Annual Meeting of Stockholders to be held on June 13, 2017 at 11:30 a.m. at 32 Wiggins Avenue, Bedford, Massachusetts 01730: This proxy statement, a form of proxy card, and our Annual Report to Stockholders are available athttp://www.anikatherapeutics.com/proxy. In addition, directions to the 2017 Annual Meeting of Stockholders are also available athttp://www.anikatherapeutics.com/proxy.

PROPOSAL 1:

ELECTION OF DIRECTORS

The Board of Directors is currently comprised of six directors and is divided into three classes: Class I, Class II, and Class III. Each class of directors serves for a three-year term, with one class of directors being elected by our stockholders at each annual meeting. Dr. SherwoodJoseph Bower and Mr.Jeffery Thompson serve as Class I Directors, with terms of office expiring at the Annual Meeting. Raymond Land and Glenn Larsen serve as Class II Directors, with terms of office expiring at the 2019 Annual Meeting of Stockholders. Joseph Darling and Stephen Wheeler serve as Class III Directors, with a termterms of office expiring at the 20172020 Annual Meeting. Meeting of Stockholders.

Dr. Bower and Mr. Thompson serve as Class I Directors with a term of office expiring at the 2018 Annual Meeting. Mr. Land and Dr. Larsen serve as Class II Directors with a term of office expiring at the 2019 Annual Meeting.

Dr. Sherwood and Mr. Wheeler are our Board’s nominees for election to the Board at the 20172018 Annual Meeting. The Class IIII Directors will be elected to hold office until the 20202021 Annual Meeting and until their successors are duly elected and qualified. Unless otherwise instructed, the persons named in the accompanying proxy will vote, as permitted by our Amended and Restated By-laws, to elect Dr. SherwoodBower and Mr. WheelerThompson as Class IIII Directors. If either of the Class IIII Directors becomes unavailable or declines to serve, the persons acting under the accompanying proxy may vote the proxy for the election of a substitute in their discretion. The Board has no reason to believe that any of the nominees will be unable or unwilling to serve if elected. There are no arrangements or understandings between any nominee and any other person pursuant to which such nominee was selected.

Vote Required

At the 2017 Annual Meeting, the election of a director requires the affirmative vote of a majority of votes cast by the holders of common stock entitled to vote at the election pursuant to our Majority Voting in Uncontested Director Elections Policy, which is described more particularly in the section titled “Majority“─Majority Voting in Uncontested Director Elections Policy” on page 14 of this Proxy Statement.below. Abstentions and broker non-votes, if any, will not be treated as votes cast and will have no impact on the proposal, except to the extent that failure to vote for an individual in the election of directors results in another individual receiving a larger percentage of votes.

Board Recommendation

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH OF THE DIRECTOR NOMINEES.

Information Regarding the Directors

The following table sets forth the name of each current director, including the nominees for Class IIII Director, his age and the year in which he became a director of Anika Therapeutics, Inc.

| Director | Term | Director | Term | |||||||||||||||||||||

| Director Name | Age | Since | Expires | Age | Since | Expires | ||||||||||||||||||

| Class I Directors: | ||||||||||||||||||||||||

| Joseph L. Bower | 78 | 1993 | 2018 | 79 | 1993 | 2018 | ||||||||||||||||||

| Jeffery S. Thompson | 51 | 2011 | 2018 | 52 | 2011 | 2018 | ||||||||||||||||||

| Class II Directors: | ||||||||||||||||||||||||

| Raymond J. Land | 72 | 2006 | 2019 | 73 | 2006 | 2019 | ||||||||||||||||||

| Glenn R. Larsen, Ph.D. | 62 | 2015 | 2019 | 63 | 2015 | 2019 | ||||||||||||||||||

| Class III Directors: | ||||||||||||||||||||||||

| Charles H. Sherwood, Ph.D. | 70 | 2002 | 2017 | |||||||||||||||||||||

| Joseph G. Darling | 60 | 2018 | 2020 | |||||||||||||||||||||

| Steven E. Wheeler | 70 | 1993 | 2017 | 71 | 1993 | 2020 | ||||||||||||||||||

| 8 |

Joseph L. Bower, D.B.A., joined the Board of Directors in February 19931993. Dr. Bower has been the Chairman of the Board since March 9, 2018, and hashe previously served as lead director sincefrom April 2005.2005 through that date. Since July 2014, he has been the Donald Kirk David Professor Emeritus at Harvard Business School. From 2008 through 2014, he was the Baker Foundation Professor of Business Administration at Harvard Business School, and prior to 2008, he was the Donald Kirk David Professor of Business Administration. Throughout his tenure, Dr. Bower also served in many administrative roles at Harvard Business School, including as Senior Associate Dean. Dr. Bower also serves as a director of Loews Corporation and the New America High Income Fund, Inc. During the past five years, Dr. Bower also served as a director of Brown Shoe Company, Inc. and Sonesta International Hotels Corporation. He holds an A.B., as well an M.B.A. and a D.B.A. from Harvard University. Dr. Bower brings to the Board more than four decades of experience in business strategy, corporate governance, leadership and management, during which time he has written books about and taught these subjects at the Harvard Business School. Additionally, he has consulted with numerous organizations on matters related to strategy, organizational development and succession planning. As a result, we believe he is well suited for his roles as Lead Directorour Chairman of the Board and as Chairperson of the Compensation Committee. Dr. Bower also serves on the Audit Committee.

Joseph G. Darling was appointed Chief Executive Officer of Anika Therapeutics in March 2018 and simultaneously became a member of the Board. Mr. Darling has served as President since July 2017. Mr. Darling served as the Executive Chairman of Arthrosurface, Inc., an orthopedic medical technology company, from September 2016 to July 2017 and as the Chief Operating Officer of Interventional Spine, Inc. (formerly Triage Medical, Inc.), a spinal medical device company, from May 2015 to September 2016. From 2008 through December 2014, Mr. Darling held a series of senior management positions at CONMED Corporation and affiliated medical technology entities focused on surgical devices for minimally invasive procedures, including acting as the Global President of Linvatec Corporation (d.b.a. CONMED Linvatec) from 2008 through December 2014 and as the Executive Vice President of Global Commercial Operations for CONMED Corporation from 2011 through December 2014. Prior to 2008, Mr. Darling held leadership roles at Smith & Nephew, Inc., including as the Senior Vice President of Sports Medicine and Biologics where launched a portfolio of new and innovative sports medicine products, Baxter International Inc., Wyeth Pharmaceuticals, Inc., and Abbott Laboratories. Mr. Darling holds a B.A. from Syracuse University. Mr. Darling brings to the Board and our company an extensive career with broad general management skills and backgrounds in both the pharmaceutical and medical device industries. He also has a strong understanding of all aspects of our business given his role as our President and Chief Executive Officer and his prior industry background, and he provides invaluable insight to the Board with respect to their decision-making functions. Mr. Darling’s strengths in commercialization activities will position Anika for success as we transform from a contract manufacturing company to a full directly commercialized company with the addition of our next generation OA treatment and our regenerative medicine portfolio. In addition to Mr. Darling’s commercial experience, Mr. Darling brings a wealth of experience in strategy development and execution, research and development, business development, and financial management.

Raymond J. Land became a member of the Board of Directors in January 2006. He also serves as chairman of the Boardboard of Directors and interim Chief Financial Officerdirectors of BioAmber, Inc., a publicly traded company developing chemicals from renewable feedstocks, and a director and chairman of the Audit Committee of Mountain View Pharmaceuticals, Inc., a privately held company specializing in biopharmaceuticals. During 2017, Mr. Land also served as the interim Chief Financial Officer of BioAmber, Inc. for approximately three months. From 2008 through 2010, Mr. Land served as the Senior Vice President and Chief Financial Officer of Clarient, Inc., an advanced molecular diagnostics company. From June 2007 to June 2008, he was the Senior Vice President and Chief Financial Officer of Safeguard Scientifics, Inc., a venture capital firm. Prior to Safeguard Scientifics, Inc., Mr. Land held executive management and Chief Financial Officer positions at Medcenter Solutions, Inc., a pharmaceutical marketing company where he was also a board member, and Orchid Cellmark, a provider of DNA testing services. Mr. Land previously served as Senior Vice President and Chief Financial Officer for Genencor International, Inc., a biotechnology company focusing on bioproducts and healthcare, from 1997 until its acquisition in April 2005. From 1991 to 1996, he served as Senior Vice President and Chief Financial Officer for West Pharmaceutical Services, Inc. Previously, Mr. Land was with Campbell Soup Company, Inc. where for nine years he held increasingly senior financial positions and also served as General Manager of a frozen food division. Prior to joining Campbell Soup, he was with Coopers and Lybrand for nine years. Mr. Land is a retired Certified Public Accountant and has a B.S. degree in accounting and finance from Temple University. Mr. Land's qualifications for membership on the Board include his extensive prior experience as chief financial officer at multiple companies, including several in the life science industry. He serves as the Chairperson and designated financial expert on the Audit Committee and as a member of the Governance and Nominating Committee.

| 9 |

Glenn R. Larsen, Ph.D., joined the Board of Directors in February 2015. He is currently Chairman, President, and Chief Executive Officer of Aquinnah Pharmaceuticals, Inc., a pharmaceutical company focused on the development of treatments for ALS, Alzheimer’s, and other neurodegenerative diseases, which he co-founded in February 2014. He is also a co-founder and Chairman of the Boardboard of Directorsdirectors of 180 Therapeutics L.P., a clinical stage musculoskeletal drug development company focusing on treating fibrosis, which he co-founded in 2013. He previously served as Chief Scientific Officer and Executive Vice President of Research and Development at SpringLeaf Therapeutics, Inc., a producer of combination drug delivery devices, from 2010 through 2013 and as Chief Operating Officer and Executive Vice President of Research and Development, and as a member of the board of directors, at Hydra Biosciences, Inc., a biopharmaceutical company, from 2003 through 2010. During his prior employment at Wyeth (now Pfizer)/Genetics Institute, Dr. Larsen served in various drug discovery and development leadership positions, including Vice President Musculoskeletal Sciences where he directed Wyeth’s second-largest therapeutic area with responsibility for Enbrel, an anti-TNF therapeutic with multi-billion dollar annual sales used to treat rheumatoid arthritis and other diseases. Dr. Larsen received his Ph.D. in Biochemistry from Stony Brook University and a PMD from Harvard University Business School. Dr. Larsen’s qualifications for membership on the Board include his strong scientific background in pharmaceuticals, biotech, orthopedicsand regenerative medicine, and his extensive experience in management, product developmentand business development at multiple companies in the life science industry, all of which provide the Board of Directors with innovative product and commercial development perspectives and insights. He serves as a member of the Compensation Committee and a member of the Governance and Nominating Committee.

Charles H. Sherwood, Ph.D., was appointed Chief Executive Officer of Anika Therapeutics in March 2002, and simultaneously became a member of the Board of Directors. Dr. Sherwood has served as President since June 2001. Dr. Sherwood previously served as Anika Therapeutics’ Chief Operating Officer beginning in June 2001, Vice President of Research and Development beginning in April 2000, and Vice President of Process Development and Engineering beginning in April 1998. Dr. Sherwood served as a consultant to Anika Therapeutics from January 1998 to April 1998. From 1995 to 1997, Dr. Sherwood was Senior Director of Medical Device Research and Development for Chiron Vision. In April 1995, Chiron Vision acquired IOLAB Corporation, a division of Johnson & Johnson where Dr. Sherwood had been Executive Director of Research and Development from 1993 to 1995, Director of Materials Characterization from 1989 to 1993, and Manager/Section Head from 1982 to 1989. Dr. Sherwood was also a part-time faculty member in the Department of Chemistry at the California State Polytechnic University, Pomona, California from 1984 to 1987. Dr. Sherwood received a B.S. in Chemical Engineering from Cornell University, and an M.S. and Ph.D. in Polymer Science and Engineering from the University of Massachusetts, Amherst. Dr. Sherwood also received a Certificate in Management from Claremont Graduate School. Dr. Sherwood brings to the Board an exceptional understanding of all aspects of our business given his role as our President and Chief Executive Officer, and he provides invaluable insight to the Board with respect to their decision-making functions.

Jeffery S. Thompson joined the Board of Directors in January 2011. He is a Partner with HealthEdge Investment Partners, LLC (“HealthEdge”),or HealthEdge, a Tampa, Florida based private equity firm that provides strategic capital exclusively in the healthcare industry. Mr. Thompson previously served as President, CEO, and Chairman of Enaltus, a HealthEdge portfolio company specializing in unique skincare solutions. Mr. Thompson currently serves as a director for various HealthEdge affiliated companies including AMC,Lifesync Corporation, MNG Laboratories, Formulated Solutions, Santus, MNG Laboratories,LLC, The Columbus Group,Organization, LLC, and Data Dimensions, LLC. Mr. Thompson also serves as a non-executive director for Sinclair Pharma, plc, a publicly traded, London-based, international aesthetic dermatology company. Prior to joining Anika, he served as President, Chief Executive Officer and Chairman of Advanced Bio-Technologies, and Enaltus,another HealthEdge portfolio companiescompany specializing in skincare solutions. Mr. Thompson also served as a director and the Chief Operating Officer for Stiefel Laboratories, Inc. (“Stiefel”), an independent pharmaceutical company specializing in dermatology. Prior to his Chief Operating Officer role, he was Stiefel’s Senior Vice President of U.S. Business Services of Stiefel Laboratories, Inc and President of Glades Pharmaceuticals. Earlier in his career, Mr. Thompson held sales and business management positions at Bausch & Lomb Pharmaceuticals and SmithKline Beecham. Mr. Thompson holds a B.S. in general science from the University of Pittsburgh. Mr. Thompson’s qualifications for membership on the Board include his prior experience in running a pharmaceutical company and his knowledge of the medical device industry, both of which provide the Board with product and business development perspectives and insights. He serves on the Audit Committee and the Compensation Committee.

Steven E. Wheeler joined the Board of Directors in 1993. Since 1997, he has been the President of Wheeler & Co., a private investment firm. He is also currently a director of HFF, Inc. During the past five years, Mr. Wheeler also served as a director of Bariston Partners, LLC, a private equity investment firm, and PingTone Communications, Inc., a privately-heldprivately held VOIP telephone services provider. Between 1993 and 1996, he was Managing Director and a director of Copley Real Estate Advisors and President, Chief Executive Officer, and a director of Copley Properties, Inc., a publicly traded real estate investment trust. From 1991 to 1993, he was Chairman and Chief Executive Officer of Hancock Realty Investors, which manages an equity real estate portfolio. Earlier, he was an Executive Vice President of Bank of New England Corporation from 1990 to 1991. Mr. Wheeler received a B.S. in engineering from the University of Virginia, an M.S. in nuclear engineering from the University of Michigan and an M.B.A. from Harvard University Business School. Mr. Wheeler brings to the Board a broad understanding of business and finance matters, as well as over 20 years of experience as a member of the Board. He serves as a member of the Compensation Committee and as Chairperson of the Governance and Nominating Committee.

The Board’s Role in Risk Oversight

The role of the Board of Directors in our risk oversight process includes receiving reports from management or a Board committee chairperson on areas of material risk to our Company,company, including operational, financial, commercial, legal, regulatory, strategic, and reputational risks. The Board has delegated primary responsibility to the Audit Committee to review these reports and discuss with management the process by which management assesses and manages our risk exposure, risk management, and risk mitigation strategies. The Audit Committee also works with other committees to assess areas of risk under the particular purview of those committees. When the Audit Committee receives a report from management or another committee, the Chairperson of the Audit Committee reports on his or her review of the report to the full Board. This enables the Board and its committees to coordinate the risk oversight role to ensure that all directors receive all significant risk-related information. The Board also administers its risk oversight function through the required approval by the Board (or a committee of the Board) of significant transactions and other material decisions and through regular periodic reports from our independent registered public accounting firm and other outside consultants regarding various areas of potential risk, including, among others, those relating to our internal controls and financial reporting. In addition, as part of its charter, the Audit Committee discusses with management and our independent registered public accounting firm significant risks and exposures, as well as the steps management has taken to minimize those risks.

| 10 |

Board Leadership Structure

Since March 9, 2018, Dr. Bower serveshas served as the Lead DirectorChairman of the Board. He previously served as lead director, and the Board of Directors.Directors did not have a Chairman. Separating the Lead DirectorChairman role and the Chief Executive Officer role allows our Chief Executive Officer to focus on the strategic management of our day-to-day business, while allowing the Lead DirectorChairman to focus on leading ourthe Board in its fundamental role of providing advice to and independently overseeing management. The Board recognizes the time, effort, and energy that the Chief Executive Officer is required to devote to his position in the current business environment, as well as the commitment required to serve as our Lead Director,Chairman, particularly as the Board’s oversight responsibilities continue to grow. The Board believes that having separate positions, with an independent, non-executive director serving as the Lead Director,Chairman, is the appropriate leadership structure for our Companycompany at this time and allows the Board to fulfill its role with appropriate independence.

Corporate Governance, Board Matters, and Committees

The Board of Directors has determined that each of its members, except for Dr. Sherwood,Mr. Darling, is “independent” within the meaning of the director independence standards of the NASDAQ Stock Market, Inc. (“NASDAQ”) and the SEC. The Board based these determinations primarily on a review of the responses of each director to questions regarding employment and compensation history, affiliations, and family and other relationships, and on other relevant discussions with the directors.

Independent directors meet periodicallyregularly in executive sessions without management participation. The executive sessions generally occur in connection with regularly scheduled meetings of the Board and committees of the Board, and at other times the independent directors deem appropriate. The executive sessions are chaired either by the Lead DirectorChairman of the Board or by the Chairperson of the Board committee having jurisdiction over the particular subject matter to be discussed at the particular meeting or portion of a meeting.

The Board reviews matters related to our corporate governance annually at a regularly scheduled meeting of the Board. This includes an evaluation of our by-laws, committee charters, shareholderstockholder rights plan, and other matters related to our governance. During this review, the Board assesses input from management and outside consultants to discern whether any actions should be taken on any of these topics. Furthermore, the Board conducts periodic evaluations that focus on the effectiveness of the Board as a whole and of its committees. Board members complete a detailed questionnaire that (a) provides for quantitative rankings in key areas and (b) seeks subjective comments in each of those areas. In addition, members of each Board committee complete a detailed questionnaire to evaluate how well their committee is operating and to make suggestions for improvement. The evaluation process is managed by the Chairperson of the Nominating and Governance Committee, with advice from outside counsel. Outside counsel conducts separate, confidential interviews with each of the directors to follow-up on responses and comments reflected in the questionnaires. An anonymized summary of the principal findings from the questionnaires and interviews is prepared by outside counsel and is used as the basis for self-assessment discussions by the Board and its committees.

The Board met foureight times during 2016.2017. No director attended less than 80% of the aggregate of (1) the total number of Board meetings and (2) the total number of meetings held by all committees on which such director served. Our Annual Meetings of Stockholders are generally held to coincide with the Board’s regularly scheduled meetings. Directors are encouraged to attend the Annual Meeting. Each of the then-current directors attended the 20162017 Annual Meeting of Stockholders.

The Board currently has three standing committees:

| Audit Committee; | ||

| Compensation Committee; and | ||

| Governance and Nominating Committee. |

The Board has adopted a written charter for each of the Audit Committee, the Compensation Committee, and the Governance and Nominating Committee, which are reviewed at least yearly by each of the committees. You can find links to these materials in the corporate governance section of our website at http://www.anikatherapeutics.com. Please note that the information contained on the website is not incorporated by reference in, or considered to be a part of, this proxy statement. Proxy Statement.

| 11 |

Audit Committee.Committee

The current members of the Audit Committee are Mr. Land, as Chairperson, Dr. Bower, and Mr. Thompson. Mr.Messrs. Land and Thompson and Dr. Bower and Mr. Thompson served on the Audit Committee throughout 2016.2017. The Board of Directors has determined that each member of the Audit Committee meets the independence requirements promulgated by NASDAQ and the SEC, including Rule 10A-3(b)(1) under the Securities Exchange Act of 1934 as amended (the “Exchange Act”).or the Exchange Act. In addition, the Board has determined that each member of the Audit Committee is financially literate and has the requisite financial sophistication to serve on the committee. The Board has also determined that Mr. Land qualifies as an “audit committee financial expert” under the rules of the SEC. Stockholders should understand that this designation is a disclosure requirement of the SEC related to Mr. Land’s experience and understanding with respect to certain accounting and auditing matters. The designation does not impose upon Mr. Land any duties, obligations, or liability that are greater than those that are generally imposed on him as a member of the Audit Committee and the Board, and his designation as an audit committee financial expert pursuant to this SEC requirement does not affect the duties, obligations, or liability of any other member of the Audit Committee or the Board.

The purposes of the Audit Committee are, among other things, to (1) oversee our accounting and financial reporting processes and the audits of our financial statements, (2) take, or recommend that the Board take, appropriate action to oversee the qualifications, independence and performance of our independent registered public accounting firm, (3) lead the review of our risk management processes and exposure to risk, and (4) prepare an Audit Committee report as required by the SEC to be included in our annual proxy statement. The Audit Committee has direct authority to appoint, retain, oversee, and, when appropriate, terminate our independent registered public accounting firm. The Audit Committee also has the responsibility to confer with the independent registered public accounting firm regarding the scope, method, and result of the audit of our books and records, to report the same to the Board, of Directors, and to establish and monitor a policy relative to non-audit services provided by the independent registered public accounting firm in order to ensure the firm’s independence.

The Audit Committee holds separate sessions of its meetings, outside the presence of management, with our independent auditors in conjunction with each regularly scheduled Audit Committee meeting in which the independent auditors participate. The Audit Committee met twelvenine times during 2016.2017.

Compensation Committee

Compensation Committee.The current members of the Compensation Committee are Dr. Bower, as Chairperson, Dr. Larsen, Mr. Thompson, and Mr. Wheeler, each of whom is independent for purposes of NASDAQ listing standards and the SEC.applicable SEC regulations. Messrs. Thompson and Wheeler and Dr.Drs. Bower and Dr. Larsen served on the Compensation Committee throughout 2016.2017. The Compensation Committee, among other things, exercises on behalf of the Board of Directors all of the Board’s responsibilities relating to the development and implementation of our compensation programs which provide incentives that further our long-term strategic plan with the goal of enhancing enduring stockholder value, including: (1) managing our overall compensation structure, policies and programs, (2) reviewing and approving corporate goals and objectives relevant to the compensation of our Chief Executive Officer and other executive officers, (3) reviewing the performance of and determining the compensation of our Chief Executive Officer, (4) reviewing the performance of and determining, with the advice and assistance of the Chief Executive Officer, the compensation of our executive officers other than the Chief Executive Officer, (5) annually reviewing and recommending to the Board compensation for non-employee directors, (6) overseeing our overall compensation programs, including granting awards under our stock option and equity incentive plan, (7) preparing a report on executive compensation to be included in our annual proxy statement, and (8) appointing, retaining, compensating, terminating, and overseeing the work of any compensation consultant or other compensation adviser, as well as considering the independence of any compensation consultant or other compensation adviser. The Compensation Committee met sixfive times during 2016.2017.

Governance and Nominating Committee.Committee

The current members of the Governance and Nominating Committee are Mr. Wheeler, as Chairperson, Mr. Land, and Dr. Larsen, each of whom is independent for purposes of NASDAQ listing standards and the SEC.Larsen. Messrs. Wheeler and Land and Dr. Larsen served on the Governance and Nominating Committee throughout 2016.2017. The Governance and Nominating Committee is primarily responsible for (1) recommending to the Board of Directors the criteria for Board and committee membership, (2) identifying, evaluating, and recommending nominees to stand for election as directors at each Annual Meeting of Stockholders, including incumbent directors and candidates recommended by stockholders, (3) matters related to executive and Board succession, (4) coordinating the evaluation of the Board and its committees, and (5) Board education programs. The Governance and Nominating Committee met five times during 2016. 2017.

When considering candidates for director, the Governance and Nominating Committee takes into account a number of factors, including the following minimum qualifications: the nominee shall have the highest personal and professional integrity, shall have demonstrated exceptional ability and judgment, and shall be most effective, in conjunction with the other members of the Board, in collectively serving the long-term interests of the stockholders. In addition, the Governance and Nominating Committee will take into consideration such other factors as it deems appropriate, including any direct experience in the biotechnology, pharmaceutical, and/or life sciences industries or in the markets in which we operate. The Board has adopted a retirement policy providing that directors will not be nominated for election to the Board after their 75th birthday, which was waived by the Board in relation to the election of Dr. Bower at the 2015 Annual Meeting due to his distinguished experience and unique leadership position with our company and the Board. The Board plans to revisit this policy in 2018. While we do not have a formal diversity policy, the Governance and Nominating Committee may consider whether the candidate, if elected, assists in achieving a mix of Board members that represents a diversity of background and experience. The Governance and Nominating Committee may also consider, among other things, the skills of the candidate, his or her availability, the candidate’s depth and breadth of experience or other background characteristics, and his or her independence. Depending upon the current needs ofIn addition, the Board thesebelieves that diversity is an important component of a board of directors and other factors may be weighed more or less heavily bygood corporate governance, including diversity of background, skills, experience, gender, race, and ethnicity. Although we do not currently have formal diversity policy, the Governance and Nominating Committee.Committee, guided by its charter, assesses and considers the diversity of the Board prior to nominating candidates and seeks to identify director candidates who will enhance the Board’s overall diversity. The Governance and Nominating Committee and the Board select candidates on the basis of qualifications and experience without discriminating on the basis of race, color, national origin, gender, sex, sexual preference, or religion. The Board has adopted a retirement policy providing that directors will not be nominated for election to the Board after their 75th birthday, which was waived by the Board in relation to the nomination of Dr. Bower for election at the 2018 Annual Meeting due to his distinguished experience and unique leadership position with our company and the Board. We believe that our current Board members collectively possess diverse knowledge, expertise, and experience in the disciplines that impact our business.

| 12 |

The Governance and Nominating Committee will consider written recommendations from stockholders of Anika Therapeutics regarding potential candidates for election as directors. The Governance and Nominating Committee will review and evaluate the qualifications of director nominee candidates who have been recommended by stockholders in compliance with procedures established from time to time by the Governance and Nominating Committee and will conduct such inquiries as it deems appropriate. The Governance and Nominating Committee will consider for nomination any proposed director candidate who is deemed qualified by the Governance and Nominating Committee in light of the minimum qualifications and other criteria for Board membership described above or otherwise approved by the Board from time to time.

Stockholders wishing to suggest a candidate for director should write to the Governance and Nominating Committee in care of our Chief Executive Officer, Anika Therapeutics, Inc., 32 Wiggins Avenue, Bedford, Massachusetts 01730 and include:

| ● | the name and address of record of the stockholder; | |

| ● | a representation that the stockholder is a record holder of our common stock, or if the stockholder is not a record holder, evidence of ownership in accordance with Rule 14a-8(b)(2) under the Exchange Act; | |

| ● | the name, age, business and residential address, educational background, public company directorships, current principal occupation or employment, and principal occupation or employment for the preceding five full years of the proposed director candidate; |

| ● | a description of the qualifications and background of the proposed director candidate which addresses the minimum qualifications and other criteria for Board membership approved by the Board from time to time; |

| ● | a description of all arrangements or understandings between the stockholder and the proposed director candidate; |

| ● | the written consent of the proposed director candidate (1) to be named in the proxy statement relating to the Annual Meeting of Stockholders, (2) to have all required information regarding such candidate included in the proxy statement relating to the Annual Meeting of Stockholders filed pursuant to the rules of the SEC and (3) to serve as a director if elected at such annual meeting; and |

| ● | any other information regarding the proposed director candidate that is required to be included in a proxy statement filed pursuant to the rules of the SEC. |

The Governance and Nominating Committee may solicit recommendations for candidates for directors from non-management directors, the Chief Executive Officer, other executive officers, third-party search firms, and such other sources as it deems appropriate, including stockholders. The Governance and Nominating Committee will review and evaluate the qualifications of all such proposed candidates in the same manner and without regard to the source of the recommendation.

Communications with the Board of Directors

If you wish to communicate with any of our directors or the Board of Directors as a group, you may do so by writing to the Board, or such individual director(s), in care of our Chief Executive Officer, Anika Therapeutics, Inc., 32 Wiggins Avenue, Bedford, Massachusetts 01730.

We recommend that all correspondence be sent via certified U.S. mail, return receipt requested. All correspondence received by the Chief Executive Officer will be forwarded promptly to the appropriate addressee(s).

| 13 |

Code of Business Conduct

It is our policy that all of our officers, directors, and employees worldwide conduct our business in an honest and ethical manner and in compliance with all applicable laws and regulations. The Board of Directors has adopted the Anika Therapeutics, Inc. Code of Business Conduct and Ethics in order to clarify, disseminate and enforce this policy. The Code of Business Conduct and Ethics applies to all of our officers, directors, and employees worldwide, including our Chief Executive Officer and Chief Financial Officer. The Code of Business Conduct and Ethics can be viewed on the investor relations section of our website athttp://www.anikatherapeutics.com under “Corporate Governance.” Please note that the information contained on the website is not incorporated by reference in, or considered to be part of, this proxy statement.Proxy Statement.

Majority Voting in Uncontested Director Elections Policy

On December 8, 2015, the Board of Directors adopted our “Majority Voting in Uncontested Director Elections Policy.” An uncontested election occurs when the number of director nominees is equal to the number of Board positions to be filled through election and proxies are being solicited for such election of directors solely by our company. Pursuant to our policy in such an election, if a director receives a greater number of votes “withheld” than “for” his or her election, such director shall promptly offer his or her resignation for consideration by the Governance and Nominating Committee. The Governance and Nominating Committee shall then consider all of the relevant facts and circumstances, and the committee shall recommend to the Board whether or not to accept such offer of resignation. The final decision of whether or not to accept such resignation shall be made by the Board, and, if required or determined by the Board to be desirable, we shall appropriately disclose the decision of the Board along with the rationale for such decision.

Transactions with Related Persons and Conflict of Interest Policy